Double materiality assessment

Double materiality assessment – a starting point for setting focus and boundaries for ESG strategy and reporting, and fulfillment of EU regulatory requirements (CSRD compliance). Your ESG efforts should prioritize aspects that matter the most. This means identifying the most significant areas of impact to the nature and people caused by business activities, and mapping areas of risks and opportunities arising from sustainability matters that affect the financials of your business.

Who needs double materiality assessment

Large Companies

250+ employees, €50+ million net turnover, €25+ million total assets and all companies listed on regulated markets in the EU (except micro) – a regulatory requirement from CSRD.

SMEs

That can benefit and gain an advantage from proving proper ESG management approach to their B2B clients, value chain partners, banks and investors.

Proactive Organizations

All companies who don`t want to deal with unnecessary sustainability issues, and instead want to allocate resources for ESG in a thoughtful, efficient, and purposeful way.

Three ways we can help

Leading complete assessment project

Leading the process, coordinating stakeholder engagement, conducting impact assessment, guiding financial risk and opportunity assessment, leading meetings and workshops, formulating final outcome.

Supporting your internal team in conducting the assessment

Acting as a mentor, advisor and external expert who can help you set up the proper process and methodology, providing our templates and scoring models, directing you to relevant resources, reviewing and feedbacking your outcomes.

Training your people on how to perform the assessment

Delivering one longer generic or series of specific training events for your management team or ESG team to prepare you for running the assessment on your own (sharing tips and tricks we have gained about applying the methodology and process).

Our double materiality assessment methodology follows

Requirements and principles of European Sustainability Reporting Standard (ESRS)

EFRAG guidelines for double materiality assessment

Sustinere`s scoring model and worksheet templates for assessing the impact and financial materiality of each ESG topic

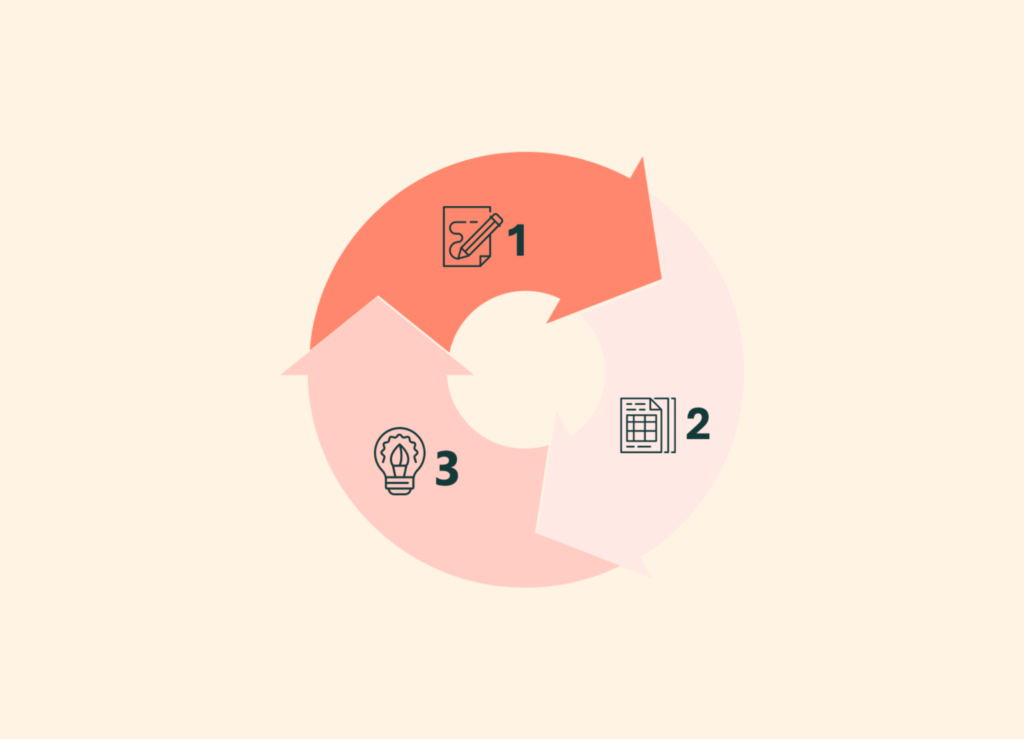

The process is divided into three main stages

Understanding the context and scope of the assessment

Outcome: your team knows why and how broad the assessment will be done considering the value chain of your company, which information is needed as an input, which stakeholders and how should be engaged.

Identification of the list of potential material sustainability matters

Outcome: shortlist of probably relevant ESG topics (based on full list of topics provided by ESRS) to be used in further assessment.

Materiality assessment from two perspectives – impact and financial materiality

Outcome: materiality map with scores and explanations about severity and likelihood of identified impacts, risks and opportunities of each topic.

Materiality assessment outside the scope of CSRD

For companies not required to comply with CSRD but still looking to enhance their sustainability efforts, we offer a lighter version of the assessment. This streamlined service provides valuable insights into the most relevant environmental, social, and governance issues for your business, helping you prioritize actions and communicate your commitments effectively without the complexity of full regulatory compliance.

The assessment is done based on inputs gathered through internal and external stakeholder engagement, review of available materials, interviews with management team members, meetings and workshops for your working group. Our experts base their evaluations on industry standards and scientific materials.

Next steps after double materiality assessment should be creating a strategy on how material ESG matters should be integrated to your business strategy; and defining disclosure points for reporting with identified gaps in complying to the requirements of the EU`s ESG reporting standard.

Why you should engage with Sustinere

- Save time

- Save budget

- Benefit from our experience

- We have needed expertice